Top ten tips for money management

As part of Talk Money week, we've teamed up with Citizens Advice to give our pharmacy family top ten tips on money management.

Money management can be a tricky topic in these challenging economic times. We have worked with our Specialist Advice partner organisation Citizens Advice Manchester to bring you our top ten tips to help you to organise your money and balance your books.

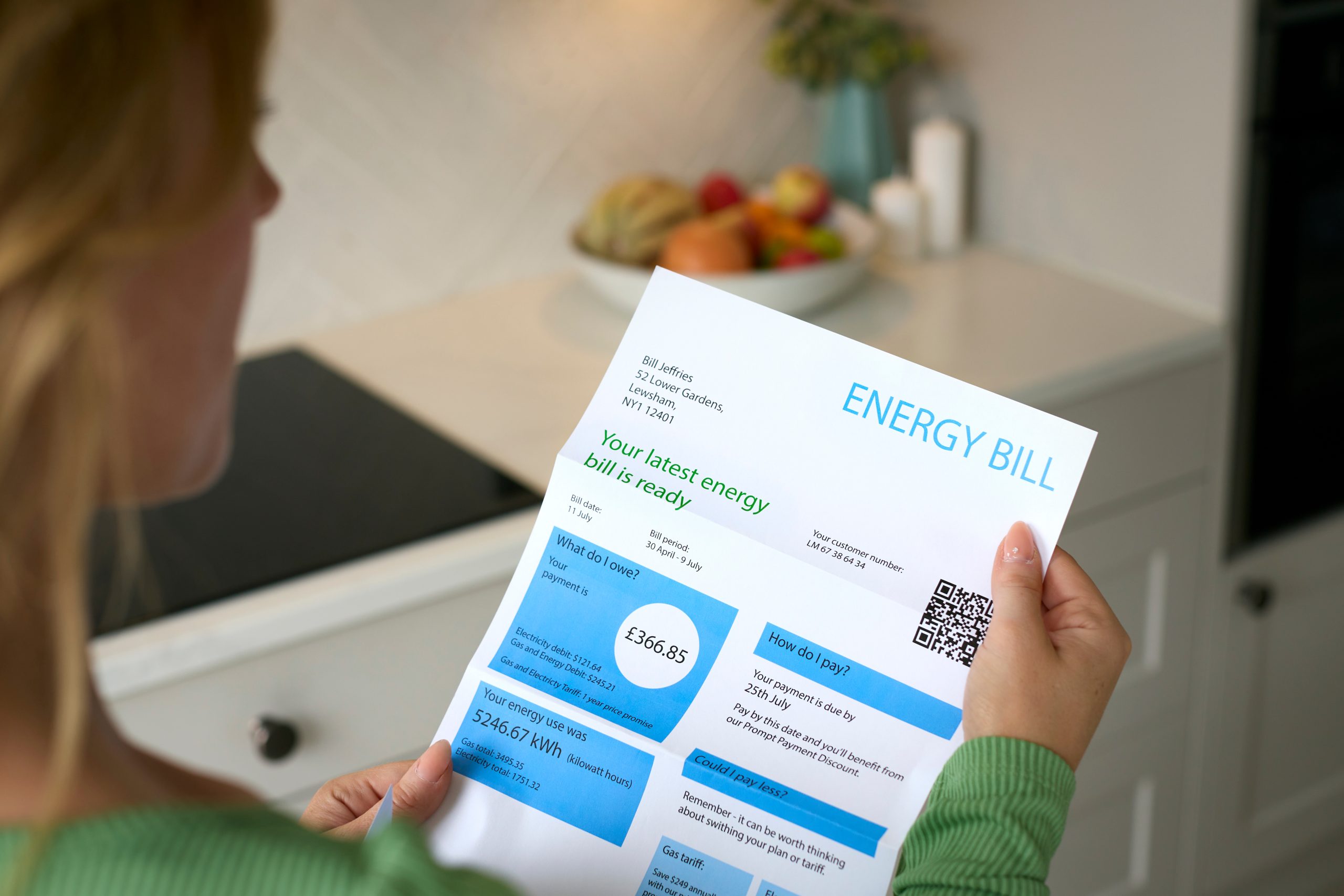

1. Prioritise essential bills

Essential bills include things like your utility bills, mortgage or rent, and council tax payments. Expenditure on travel costs for work, registration renewal, and your insurance should be included in your priorities as these are essential for you to work. If you have outstanding balances on credit cards and loans you might want to think about paying more than the minimum monthly amount due if possible, but never at the expense of the essentials. Looking for good deals on interest for credit cards can be useful, but be careful as interest rates on these cards is often high once the interest free period expires. If things get out of hand seek advice.

Find out more about our Specialist Advice

2. List incomings and outgoings

Now you can begin to plan your budget. Make a list of all the money you have coming in and all the essential bills and expenditure. This will include items such as food, clothing, and other household essentials. If there is a shortfall rather than an excess, you will need to think about other ways of maximising your income. You could also consider using a budget planning tool.

3. Track where your money is going

Have a look at your bank and credit card statements over the last twelve months. Are you spending any money unnecessarily? Take a look at your direct debits. Keep an eye on any monthly subscriptions; if you know when they are going to end, you might be able to negotiate a better deal.

4. Avoid wasting money

Do you enjoy buying a coffee every morning on your way in to work? If you spend £2 a day on a hot drink this would amount to £520 every year. Why not invest in a flask and you can still enjoy your hot drink every day whilst saving yourself over £500 every year. These savings could be increased further by making your own lunch to take to work. Before you make a purchase, be it large or small, ask yourself whether you really need it. If you don’t need it, don’t buy it. Keep a money diary for a period of time to track those little payments we don’t think about in our daily lives. It can give you detailed insight into your spending habits. If you don’t need it, don’t buy it.

5. Shop around

If you have an essential purchase to make, it is always worth shopping around first to make sure you have the best deal before you lay out any money. If you don’t have time to look locally, you can take a look online and sort out the best deal from there. You could also use price comparison sites to be sure you are getting value for money.

6. Open a savings account

You should always try to plan for the unexpected. Your washing machine may need replacing or your car made need repairs. You never know when this might happen. Open a savings account and try to save a regular amount every month to help you to plan for such eventualities.

7. Maximise your money

Have a look at whether you can increase your monthly income. Can you take on a couple of extra shifts at work? Are you claiming all benefits that you might be entitled to? If there are any benefits due to you, you should make a claim as soon as possible. If you are not sure whether there are any benefits that you can claim, we can help. Contact us via our Specialist Advice service and we can refer you to our specialist benefits adviser for a full benefits check.

8. Deal with your debts

Don’t avoid your debts. If you are struggling to pay you can try contacting your creditors to see if you can negotiate a reduced payment rate. Telling them that you are having financial difficulty allows them to look at options to help you. You might also find it helpful to seek some debt advice. For Citizens Advice information and guidance see our webpage on help with debt.

You can find out more about dealing with debt at Money Helper. If you are still not sure about dealing with your debt, we can refer you to our specialist debt adviser via our Specialist Advice service.

9. Set a savings goal

Saving money every month can be hard, so it helps to set yourself a goal. This could be saving the deposit for your first home, home improvements, or a holiday. Having a goal will encourage you to set some money aside every month for something that you really want. For further information about saving see the Money Helper website.

10. Stick to your budget

Once you have organised your money and know what you must spend each month, make sure you stick to it. Don’t be tempted by impulse buys and don’t go food shopping without making a list of items you need first. If you stick to your list, you are less likely to waste your money on non-essential food buying.